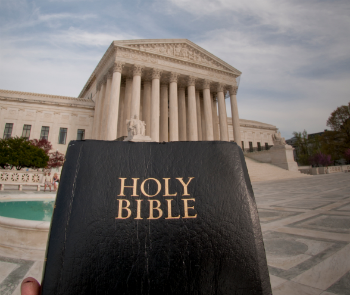

Supreme Court sides with church in playground case

FREE Catholic Classes

The Supreme Court has ruled 7-2 in favor of Trinity Lutheran Church, that Missouri's denial of the church's application to have its playground resurfaced using state funds violated the Constitution by discriminating against a religious organization. By rejecting the application, the state violated the Church's free exercise of religion.

The Supreme Court has ruled in favor of religious freedom, but the ruling is limited.

Highlights

Catholic Online (https://www.catholic.org)

6/26/2017 (6 years ago)

Published in Politics & Policy

Keywords: Supreme Court, church, Trinity Lutheran

LOS ANGELES, CA (California Network) -- The Missouri Department of Natural Resources has a program whereby it uses recycled rubber to resurface playgrounds. The resurfaced grounds are safer than asphalt and protects kids from injury when they fall. Trinity Lutheran Church applied to the program for its own playground and its application was denied because Trinity Lutheran Church is a religious organization.

The program ranked the church's application fifth out of 44 applications it received, but despite qualifying, it did not grant money from the state treasury. The program funded 14 other requests.

The church challenged the decision, claiming the denial violated the Establishment clause of the First Amendment.

Chief Justice Roberts dealt with the matter in straightforward fashion. In reviewing similar cases, Roberts concluded that the state needs a very good reason to use religious identity to deny a benefit for which someone is otherwise eligible. The funding was denied simply because Trinity Lutheran was a church. There was no compelling reason why the state should deny the funds. The state would not have been seen as endorsing the church or promoting it.

The decision was supported by all the justices except Ruth Bader Ginsburg and Sonia Sotomayor who wrote an opinion against it. According to the liberal justices, the decision breaks the barrier between the church and state, and requires the state provide funds to the church.

Justice Stephen Beyer, although he ruled in favor of the church cautioned against concluding this means churches can expect other benefits from the states.

Roberts acknowledged that the stakes in the case seemed low.

What does this decision mean for the rest of the nation? It may not mean much, as Roberts and Beyer pointed out. Or, it could mean that churches will now be able to access a host of state programs.

The implications of the case are unclear, and it will require future decisions to fully appreciate the impact of the ruling.

Subscribe Now - Catholic Online YouTube

---

'Help Give every Student and Teacher FREE resources for a world-class Moral Catholic Education'

Copyright 2021 - Distributed by Catholic Online

Hi readers, it seems you use Catholic Online a lot; that's great! It's a little awkward to ask, but we need your help. If you have already donated, we sincerely thank you. We're not salespeople, but we depend on donations averaging $14.76 and fewer than 1% of readers give. If you donate just $5.00, the price of your coffee, Catholic Online School could keep thriving. Thank you. Help Now >

Hi readers, it seems you use Catholic Online a lot; that's great! It's a little awkward to ask, but we need your help. If you have already donated, we sincerely thank you. We're not salespeople, but we depend on donations averaging $14.76 and fewer than 1% of readers give. If you donate just $5.00, the price of your coffee, Catholic Online School could keep thriving. Thank you. Help Now >

Join the Movement

When you sign up below, you don't just join an email list - you're joining an entire movement for Free world class Catholic education.

-

-

Mysteries of the Rosary

-

St. Faustina Kowalska

-

Litany of the Blessed Virgin Mary

-

Saint of the Day for Wednesday, Oct 4th, 2023

-

Popular Saints

-

St. Francis of Assisi

-

Bible

-

Female / Women Saints

-

7 Morning Prayers you need to get your day started with God

-

Litany of the Blessed Virgin Mary

Pope Francis Calls on Faithful to Embrace Faith, Hope, and Charity in New Teaching Series

-

Pope Francis Explores the Spiritual Legacy of St. John Paul II

-

Robert F. Kennedy Jr.'s Proposes Daycare Plan to Reduce Abortions in America

-

A Grandparent's Love: 3 Bible verses to read to grandchildren

-

Pope Francis to Host Grandparents and Grandchildren at Vatican

Daily Catholic

Daily Readings for Thursday, April 25, 2024

Daily Readings for Thursday, April 25, 2024 St. Mark: Saint of the Day for Thursday, April 25, 2024

St. Mark: Saint of the Day for Thursday, April 25, 2024 Prayer for Policemen: Prayer of the Day for Thursday, April 25, 2024

Prayer for Policemen: Prayer of the Day for Thursday, April 25, 2024- Daily Readings for Wednesday, April 24, 2024

- St. Fidelis of Sigmaringen: Saint of the Day for Wednesday, April 24, 2024

- A Prayer for Special Intentions: Prayer of the Day for Wednesday, April 24, 2024

![]()

Copyright 2024 Catholic Online. All materials contained on this site, whether written, audible or visual are the exclusive property of Catholic Online and are protected under U.S. and International copyright laws, © Copyright 2024 Catholic Online. Any unauthorized use, without prior written consent of Catholic Online is strictly forbidden and prohibited.

Catholic Online is a Project of Your Catholic Voice Foundation, a Not-for-Profit Corporation. Your Catholic Voice Foundation has been granted a recognition of tax exemption under Section 501(c)(3) of the Internal Revenue Code. Federal Tax Identification Number: 81-0596847. Your gift is tax-deductible as allowed by law.

Daily Readings for Thursday, April 25, 2024

Daily Readings for Thursday, April 25, 2024 St. Mark: Saint of the Day for Thursday, April 25, 2024

St. Mark: Saint of the Day for Thursday, April 25, 2024 Prayer for Policemen: Prayer of the Day for Thursday, April 25, 2024

Prayer for Policemen: Prayer of the Day for Thursday, April 25, 2024